Under Auction Charges & Tax you can update the default Buyer's Premium auction charge to be applied to the hammer price to as well as configure any number of tax rates that might be applicable for your business.

All invoices generated post auction are automatically calculated based on the charges and tax rates configured here.

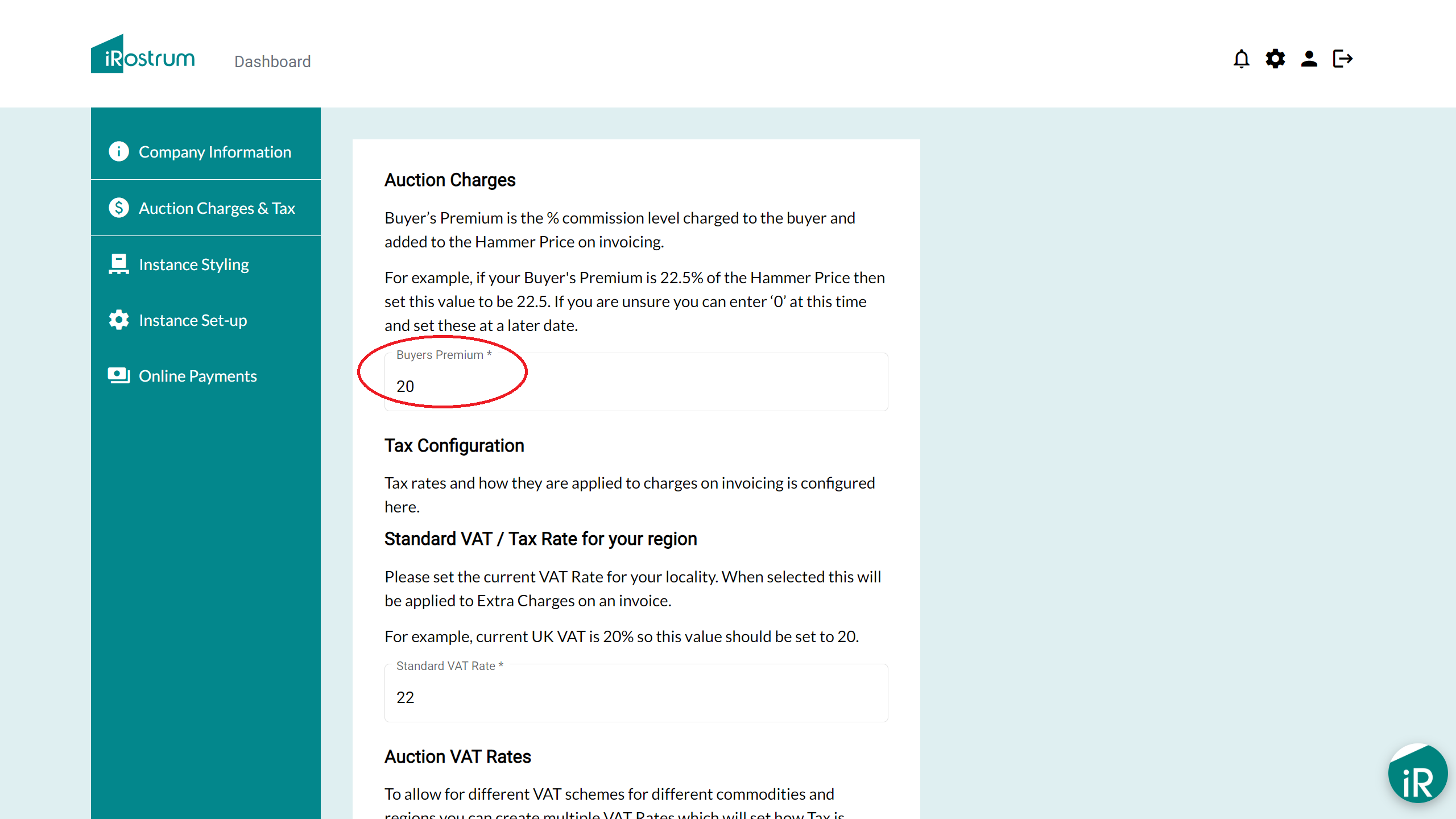

Buyer's Premium is the % commission charged to the buyer that is added to the Hammer Price .

For example, if your Buyer's Premium is 22.5% of the Hammer Price then set this value to be 22.5.

On generating invoices a charge of 22.5% will be added to each lot against the Hammer Price.

It is not a requirement to charge Buyer's Premium so if your business does not need to charge this it can be set to 0.

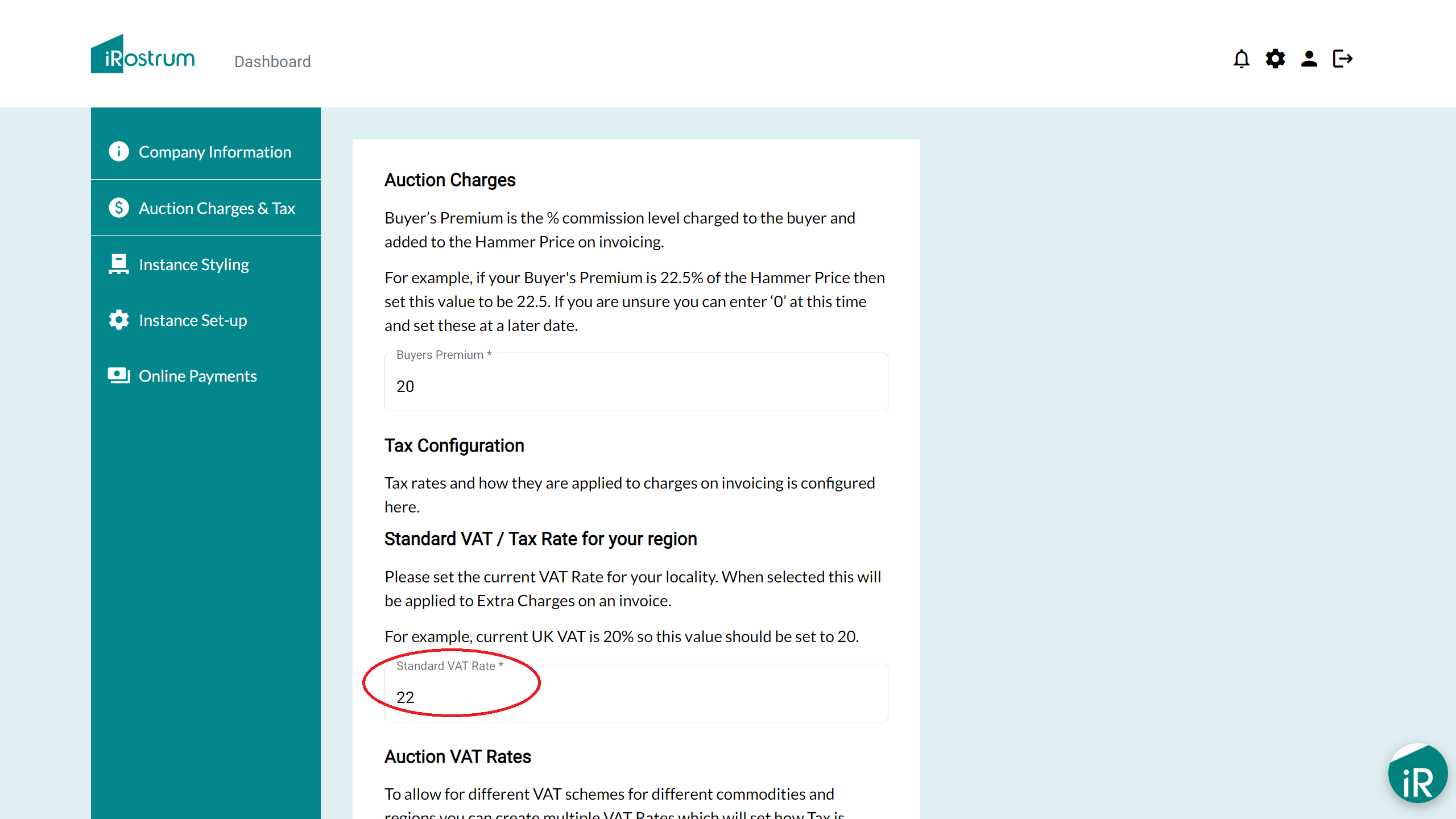

This is the Standard VAT rate to be applied to any Extra Charges added to an invoice if VAT is selected.

Your instance comes with the Standard VAT Rate set to a default of 20%, but can be updated any time to reflect the current VAT Rate for your region.

For example, the current UK VAT rate is 20% so the value should be set to 20.

If there is no requirement to charge VAT on any charges then set this to 0.

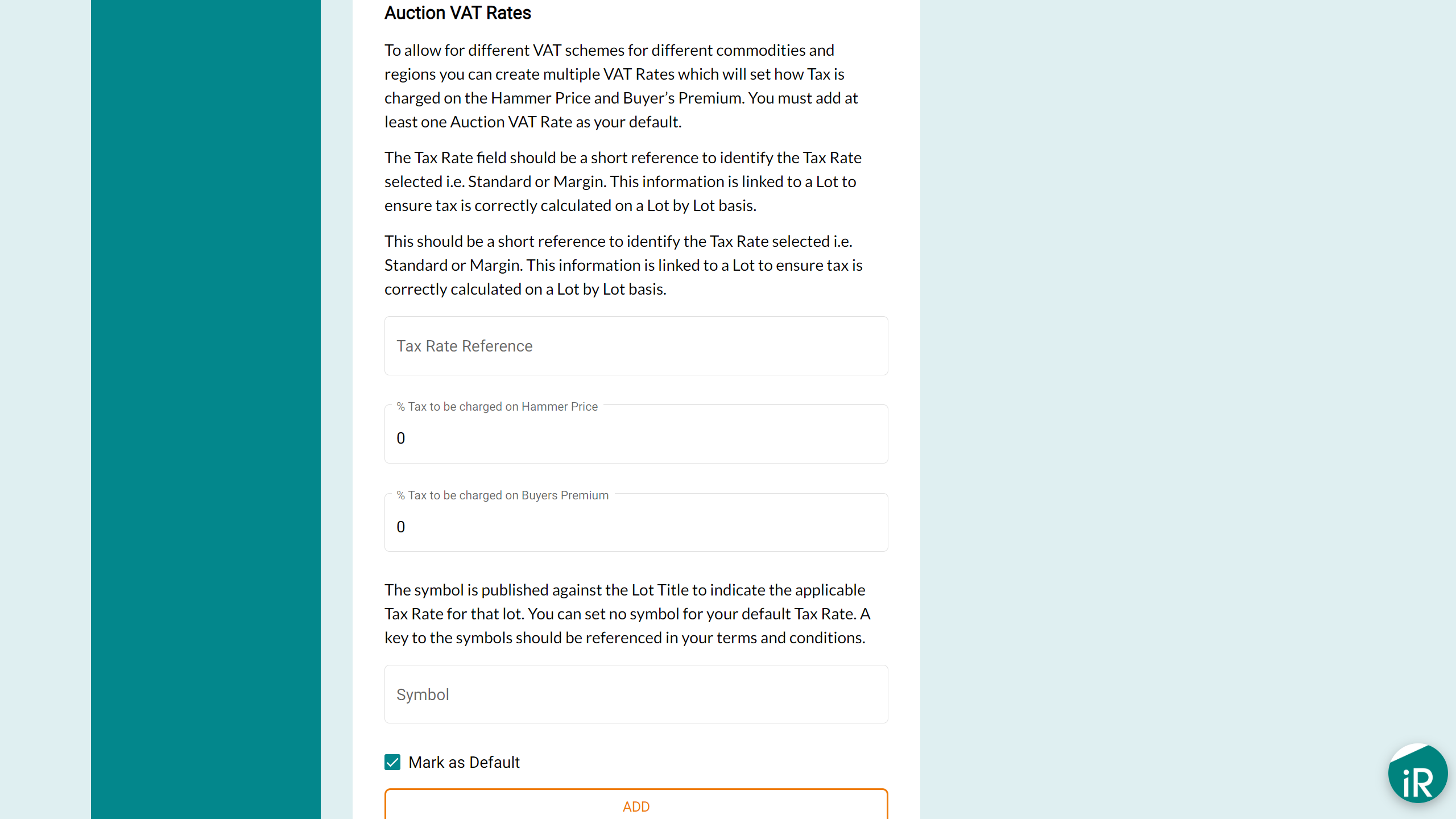

The system allows you to set multiple VAT rates for different tax schemes to allow for the different rules that might apply for different commodities, different regions or different import or export rates.

For example:

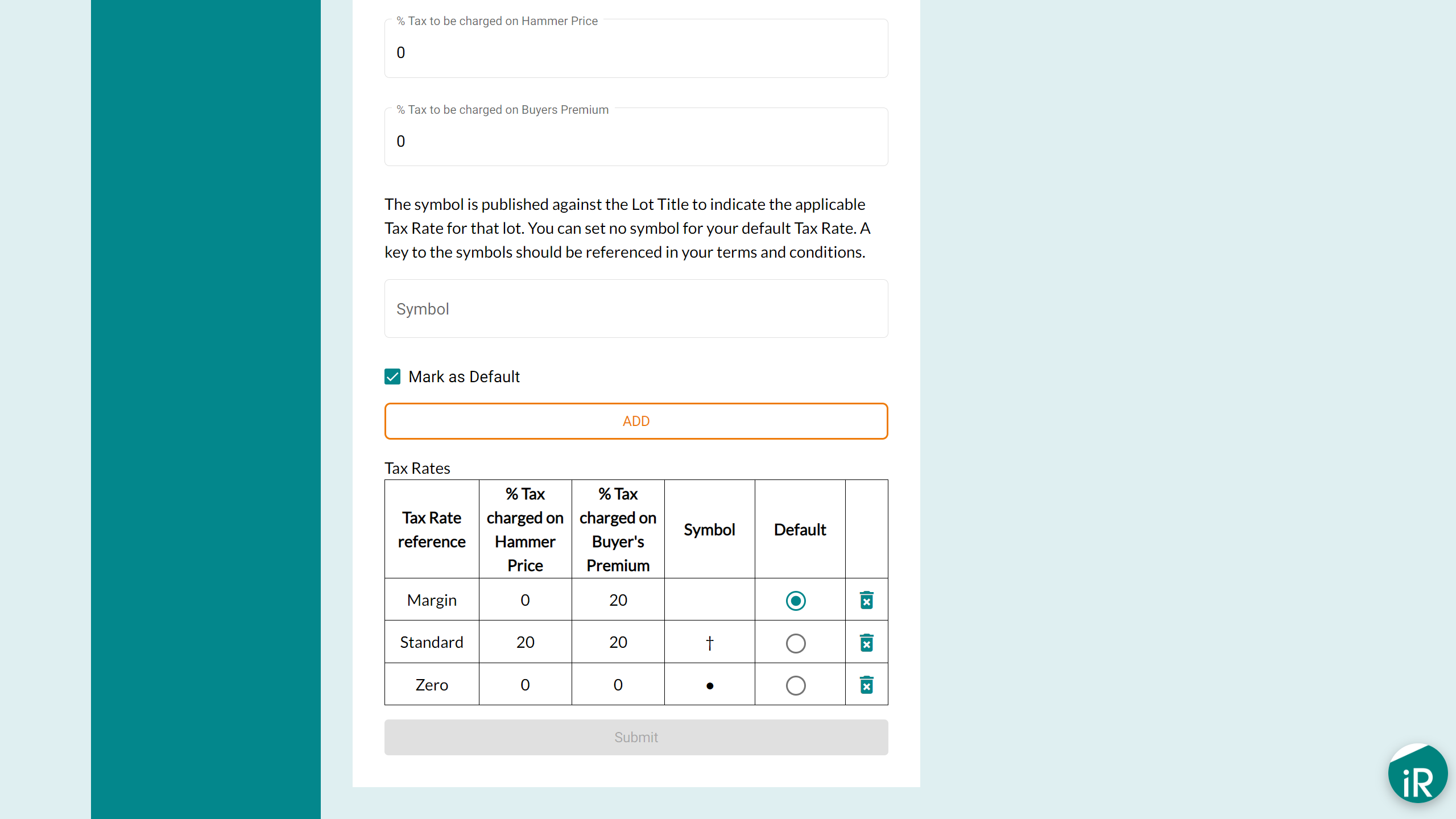

Under the UK Auctioneer Margin Scheme zero VAT is charged on the Hammer Price and 20% VAT is charged on the Buyer's Premium.

Artworks imported under Temporary Admission from outside the UK have 5% import VAT charged on the Hammer Price and 20% VAT is charged on the Buyer's Premium.

Some commodities, such as books, do not require any VAT to be charged on their sale so VAT would be charged at 0 on the Hammer Price and 0 on the Buyer's Premium.

By creating multiple VAT Rates each lot can have the appropriate VAT Rate applied, which will determine how Tax is charged on the Hammer Price and Buyer’s Premium when invoices are generated.

Your instance will come with three VAT Rates pre-populated as per the table shown in this section. You can add further VAT Rates to reflect the requirements of your business.

Note: You must add at least one Auction VAT Rate as your default.

The VAT Rate can be set on a lot by lot basis so that VAT is calculated appropriately for each lot based on the settings here.

To set up a new Auction VAT Rate enter the fields and click [Add]. All VAT rates will appear in the table below. If you have one VAT rate that you use primarily you can set this as the default and all lots added to an auction manually will have this set as the default VAT Rate.

The 'Tax Rate Reference' is the short title to describe the VAT Rate. This will appear in the drop down list on entering lots manually. If bulk uploading lots via a CSV file this field will need to match exactly so we recommend using short descriptions, i.e. Margin, Standard, Low Rate, High Rate etc.